What is an Exponential Moving Average?

The Exponential Moving Average (EMA) weighs current prices more heavily than prior prices that it takes into consideration. This gives the Exponential Moving Average the advantage of being quicker to respond to price fluctuations than a Simple Moving Average; however, that can also be viewed as a disadvantage because the EMA is more prone to whipsaws (i.e. false signals).

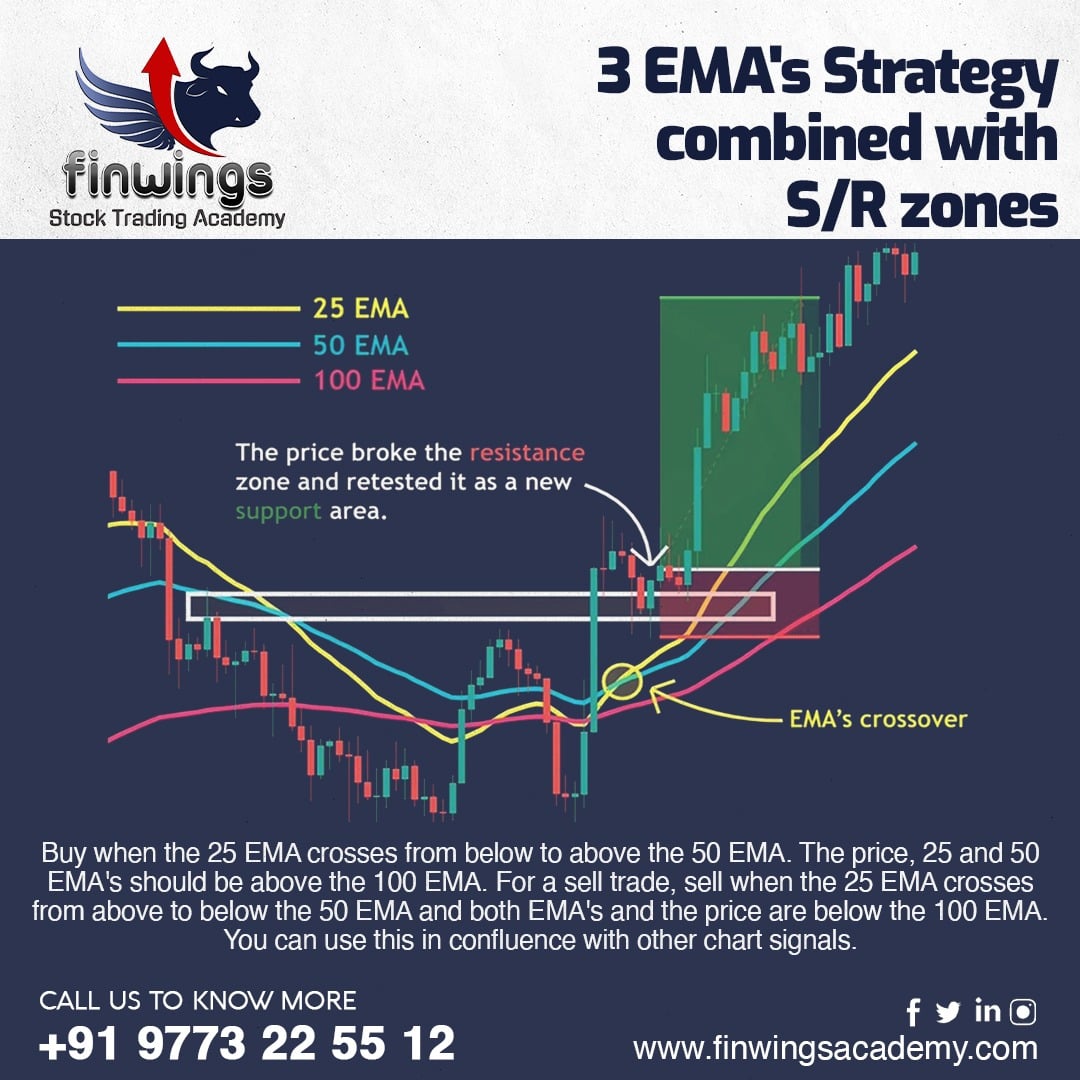

So the Indicator should be used in confluence with the Market Structure and trade only when the trend is moving on either side with good momentum.

Simple Moving Average VS Exponential Moving Average –Which is Better?

A question about moving averages that seems to weigh heavily on traders’ minds is whether to use the “simple” or “exponential” moving average.

The choice of moving average depends on various factors like your trading frequency, investing style, and the stock which has been traded by you.

The simple moving average obviously has a lag, but the exponential moving average may be prone to quicker breaks. Some traders prefer to use exponential moving averages for shorter time periods to capture changes quicker.

Some investors prefer simple moving averages over long time periods to identify long-term trend changes. In addition, much will depend on the individual security in question. A 50day SMA might work great for identifying support levels in INFOSYS but a 100-day EMA may work better for the ACC. Moving average type and length of time will depend greatly on the individual security and how it has reacted in the past.

𝐖𝐞𝐞𝐤𝐞𝐧𝐝 𝐚𝐧𝐝 𝐰𝐞𝐞𝐤𝐝𝐚𝐲𝐬 𝐛𝐚𝐭𝐜𝐡𝐞𝐬 𝐰𝐢𝐭𝐡 𝐚 𝐦𝐚𝐱𝐢𝐦𝐮𝐦 𝐨𝐟 𝟓 𝐫𝐞𝐠𝐢𝐬𝐭𝐫𝐚𝐭𝐢𝐨𝐧𝐬 𝐩𝐞𝐫 𝐛𝐚𝐭𝐜𝐡.

𝐋𝐢𝐧𝐤𝐞𝐝𝐈𝐧: https://www.linkedin.com/company/finwings-stock-trading-academy/

𝐓𝐰𝐢𝐭𝐭𝐞𝐫: https://twitter.com/FinwingsA

Call Now for More Details – 9773225512