Shooting star candlestick pattern

What are the important points to analyze candlestick patterns correctly? What is the psychology behind the formation of the candlestick patterns?

Nowadays, Trading in the stock market with the help of a candlestick chart is very common. But more often people fail to confirm the reliability of the pattern formed. The dilemma to enter the trade and how to set the best risk-reward are the prime concerns traders experience.

First of all some basics and then we will talk about the PSYCHOLOGY behind every pattern formed.

- There are 2 types of candlestick patterns 1. Reversal Candlestick pattern 2. Continuation Candlestick pattern.

- These patterns are sub-divided into more 1–2–3–4–5 day candlestick patterns. This number of days represents how many days the pattern takes to complete and then analyze it and take action. More the days rarely the candlesticks patterns are formed and are more reliable.

I have my way of looking at the candlesticks and analyzing their characteristics, like who dominated (buyers/seller), What is the size of the candle as compared to previous candles, Where the body is placed (upper part or lower part of the trading range), comparing preceding candles with the current candle’s range and the volume during the whole period.

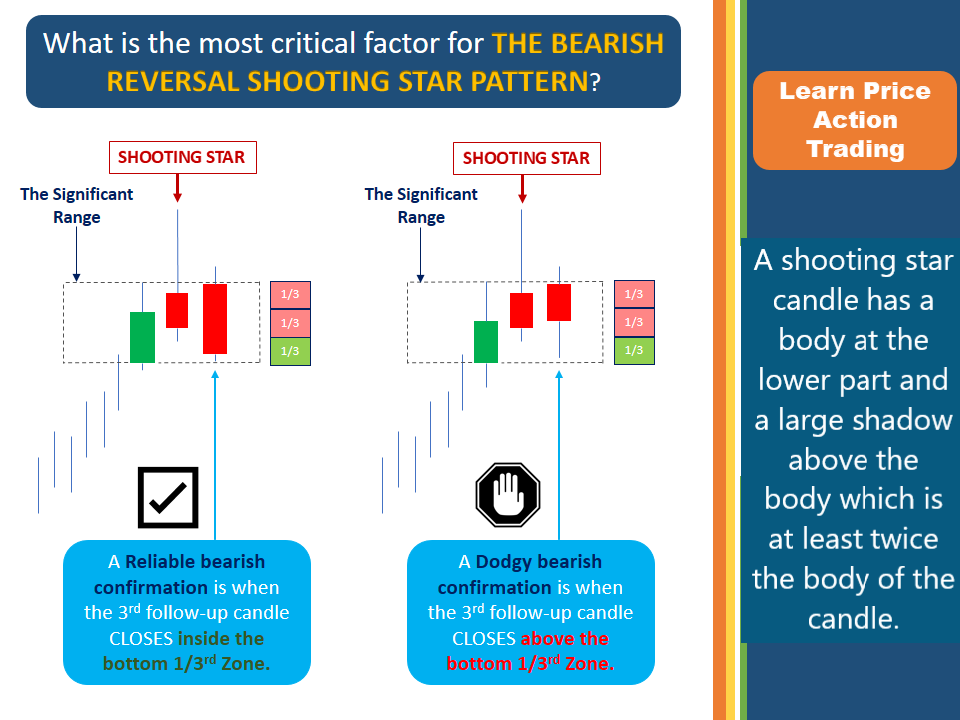

Most Importantly I analyze the subsequent – follow-up candle formed after the candlestick pattern to enter the trade.

Below is an example that most people under-rate to take into consideration.

The closings are always important in the technical analysis prospect.

The higher VOLUME during the pattern formation, the more reliable the patterns tend to blow off, as there is an increase in the participants.

For more learning also follow us on Instagram- https://www.instagram.com/finwings_stocks/

Telegram Channel – https://t.me/finwingsstocks

TRADING PSYCHOLOGY – SHOOTING STAR CANDLESTICK PATTERN

During an impending uptrend, the sellers are less and buyers continue to buy on every downtick, at some level of resistance (any significant level) or at a price where the smart guys (market makers) think the security is overvalued – More selling side trades are placed than buy orders. *The volume should increase during reliable candlestick pattern FORMATION is because of this more interest by the market participants.

- Finally, the pattern is confirmed when more retail buyers come to buy as they feel they are getting the security at a lower price which was trending upwards for a significant time, their BUY orders are filled by the “Market Makers” who have already bought at a very lower price and are exiting at euphoria.

This is how the reversal occurs, remember that candlestick patterns formation and their subsequent moves are the minor trends that form an intermediate or secondary trend.

- A candlestick pattern formed in the direction of the secondary trend is more reliable than the one in the opposite direction. For Example, If there is a bullish reversal candlestick formation then the secondary trend must be UP, and vice-versa for bearish candlestick formation.

Most people think that Retail Traders are trapped every time, this is because they don’t absorb the moves of the market seriously or analyze the securities in an analytical way and just trade the prices.

Is a shooting star candlestick bullish?

No, a shooting star is a bearish candlestick that has a tiny actual body close to the day’s bottom, a lengthy upper shadow, and little or no lower shadow and appears after an up trend. In other words, a shooting star is a particular kind of candlestick that appears when a security opens, makes a strong move, and then closes the following day just before it opens up again.

What is a shooting star candlestick pattern?

When a security’s opening price is higher than its closing price and the positive fluctuation (the day’s highest price) is larger than twice that difference, the candlestick pattern known as the shooting star candlestick is formed. The closing price or less is the lowest price for the day.

How accurate is shooting star candlestick?

The stock market’s opening and closing price levels are displayed in the candlestick’s body. It indicates that the starting and closing prices were extremely close to one another if it is too short. Additionally, a shooting star is seen to be stronger the more its attributes are highlighted in a trading chart.

The closing price is the most crucial element in this kind of pattern. The shooting star candlestick pattern is stronger when the ending price is lower than the beginning price, which, for instance, shows the net price reduction throughout the time period covered by the candlestick.

What is the difference between shooting star and doji?

The shooting star pattern and the doji candlestick pattern have strong visual similarities. The primary difference between the two reversal bearish patterns is that the shooting star should ideally close near the bottom of the candle with a short (red) body, whilst the doji has no body but the open and close are at the same price, or very close to it. The lengthy upper wick indicates that bulls are losing control and momentum and that the price movement is about to reverse.

Which candle is the most bullish?

A black or full candlestick is bearish and denotes selling pressure since it suggests the closing price for the period was lower than the opening price. A white or hollow candlestick, on the other hand, indicates that the closing price was higher than the opening price. This indicates buying pressure and is positive.

Thanks.