Nifty 50 Positional View

Nifty 50 Positional View

Nifty50 shows no sign of weakness and eye new highs. Major supports are shifted way above the bears could dominate further.

The market is near the crucial territory. It would be prudent to continue following every rise with strict trailing stop losses in place to protect profits at higher levels. METALS, BANKING, PHARMA were in the lagging phase contributing to the rise of the benchmark.IT, REALITY, AND ENERGY were the major sectors showing a bullish trend further from here. BANKNIFTY should perform from here over for NIFTY to trade at higher levels, being one of the major underperformers in the current trend.

Daily Time frame Analysis

- On Friday Nifty 50 the benchmark Index closed at 17323.60 (+89.45) (+0.52%), marking an all-time high.

- Nifty 50 formed a healthy bullish candle on weekly and daily time frames, indicating momentum to continue further in the upcoming season. Nifty 50 has captured (+618.40) in a week.

- Going ahead from here, there are higher chances market may continue to be volatile with positive bias.

- The immediate support has shifted higher to the 17200 level, even though it is the 17050 level which would be the key point for a reversal in the current minor trend. A higher target of 17400 and 17600 is possible in upcoming sessions this week.

- The weekly RSI stood at 77.44, which is a bullish indication for the current trend indicating momentum to continue. The RSI is mildly overbought. However, it remains neutral and does not show any divergence against the price. A slight bad global cue may trigger profit booking to force nifty to retest its support zone before moving ahead.

- The weekly MACD is bullish and remains above the Signal Line.

- The ichimoku cloud currently suggests that the magnitude for the current minor trend might weaken, the overbought indication in Daily RSI and a weak up leaning cloud could dampen the move to supports.

- The daily RSI seems to take a support at 50-60 before the index moves above the 18000 mark. WAIT TO BUY

- A MEAN REVERSION or a pullback price will be a good entry with less risk to enter from here to long the stocks.

- The investors should eye for 16400- 16800 levels for fresh buying in equities.

- FIIs have net bought Rs 6868 crore and DIIs sold Rs 1421 crore worth of equity shares last week in the cash market.

- On the option data, maximum Put open interest was seen at 17300pe followed by 17200pe strikes while maximum Call open interest was seen at 17400ce – 17500ce.

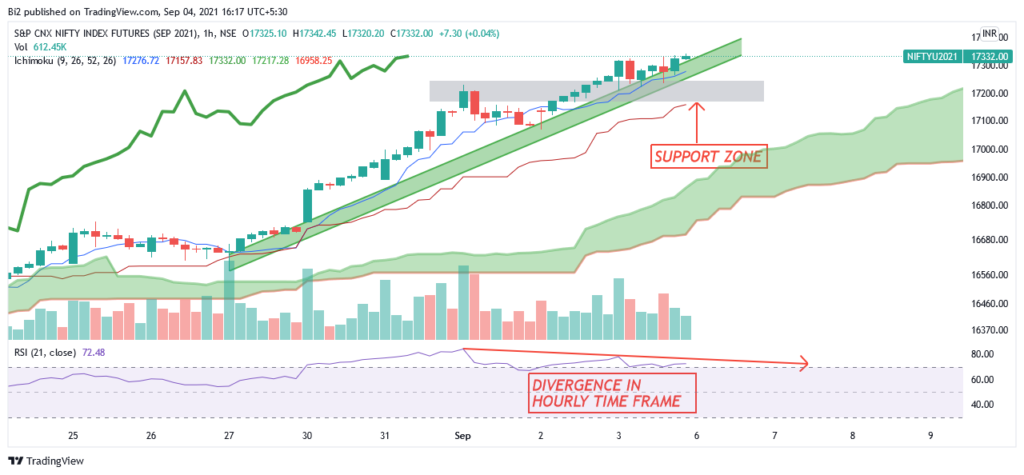

Hourly Time Frame Analysis

- The Nifty in the hourly charts took support near (17170-17240) after breaking the range in the last half of the week and marking a fresh high.

- A strong Bullish candle formed in daily charts of Nifty after a mild gap up and closing at day’s top.

- Analyzing the Nifty future Open Interest Data from the past week to the current day, a significant increase by 10% with a healthy a LONG BUILDUP was seen.

- Understanding Ichimoku Cloud, Lagging Span remains above the current price, as long as lagging span remains above current there are chances trend may remain strong with minor retracements.

- Hourly RSI(21) at 72.48 is currently at an OVER BOUGHT ZONE level indicating the trend is currently overstretched and showing DIVERGENCE concerning the current price.

- Avoid making fresh LONG POSITION as markets are highly overbought.

- Any DIPS towards 16800-17050 would be an opportunity to enter long in indices futures or sell puts.

- Any closing below 17050 will be a trend reversal for day & swing traders.

- Volatility increased as INDIA VIX rose FROM 13.40 to 14.54(+8.49%) levels weekly basis.

FIBONACCI LEVELS TO WATCH FOR INTRADAY AND SWING TRADING

16820 – 16950 – 17065– 17150 – 17353- 17586

ALGO-ROBO TRADING PLATFORM

Finwings stock trading academy is one of the best stock trading academies in India providing crash courses, short-term courses, and medium-term courses focusing on those who want to be a trader or invest in the Indian stock market. We offer career-oriented courses like; a part of BFSI, NSE courses, SEBI courses, and BSE certification courses which are considered principle series to excel your career in the financial market. We offer both online as well as offline lectures. We are here to train the individuals from the basic to the advanced level along with the necessary theoretical and practical knowledge. We conduct various tests and virtual analyses to measure the performance of our students.

Apart from the training related trading and investment, our academy provides different financial services to retail traders seeking to generate consistent profit from the stock market.

Why FINWINGS Stock Trading Academy?

- We provide our software for linking ALGO trading to your De-mat account.

- We have our own self developed and back-tested strategies for different segments.

- Anyone can create their own trading strategy on our platform with easy comprehension.

- Fully risk managed strategies with lowest slippage in the market.

- Low Fixed-Cost trading setup for small traders – No profit sharing to us.

- Full life-time backhand support to our clients.