- Open Interest Dilemma

- Commodity Market Trading

- Listen The Whistles Of The Markets

- Advanced Trading Setup With Renko Chart

Open Interest Dilemma

The course explains the method to analyse the Indices Nifty-Bank Nifty with their Option Chain and OI Trends. The course includes the practical application of OI analysis during the live markets. For Intraday and Positional trader facing difficulties in predicting the trend, this crash course will help them amplifying their trading setup.

LEARNING OUTCOMES :

- Introduction To Derivatives

- Understanding Index

- Introduction To Forward And Future

- Volume & Open Interest Interpretation

- All About Options – Options Chain Analysis – PCR

Duration: 6hrs Theory – 4hrs Practical

PRICE: ₹7999.00

Commodity Market Trading

Nowadays Commodity market trading has increased significantly in India as more and more trading securities are being introduced and the regulations are tightened. The course will provide how the commodity market trading takes place in an electronic form and different securities traded, despite the geographical locations

LEARNING OUTCOMES :

- Introduction To Commodity Derivative

- Instruments Available For Trading

- Pricing And Using Commodity Derivatives

- The NCDEX Platform

- Clearing, Settlement And Risk Management

- Regulatory Framework

Duration: 10hrs Theory – 2hrs Practical

PRICE: ₹7999.00

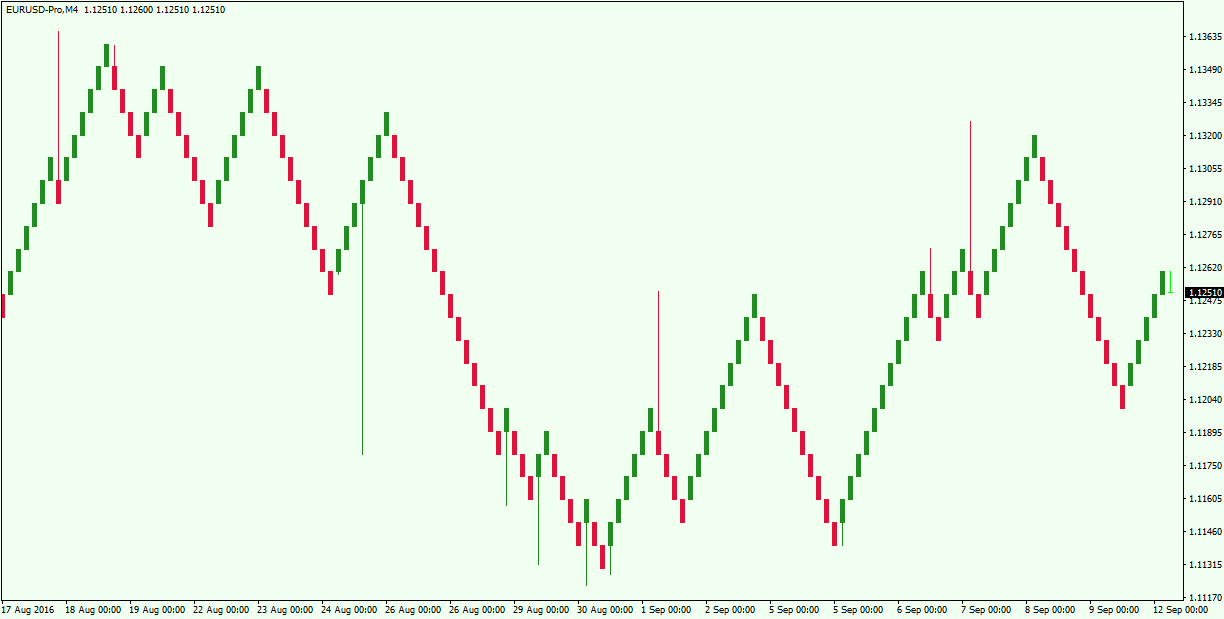

Listen The Whistles Of The Markets

This is a crash course for those who are beginners in the technical analysis field for reading the price action and confirming the strength in the movements. The course ultimately provides a trading strategy which helps the positional traders and short term investors to maximize their profits. This Strategy is more applicable for Cash and Futures Segment.

LEARNING OUTCOMES :

- Charts And Candlestick Study

- Support & Resistance - Trendlines

- Relative Strength Index (RSI)

- On Balance Volume (OBV)

- Trading Strategy – Putting It All Together

- Risk Management

Duration: 10hrs Theory – 2hrs Practical

PRICE: ₹8999.00

Advanced Trading Setup With Renko Chart

In Technical Analysis you may not often find strategies that gives a clear participation on prices and reduces the noise created in the market (Volatility). Renko Chart plotting explains the market reversal; a definite signal generated by the strategy discussed in this course let the short term and Investors to adjust their positions and portfolio accordingly.

LEARNING OUTCOMES :

- Renko Chart And Its Applications

- Ichimoku Cloud And Its Components

- Volume Analysis In Conjunction With Candlestick Charts

- Trading Strategy – Putting It All Together

Duration: 8hrs Theory – 2hrs Practical

PRICE: ₹7999.00