Confluence Trading

Which is the reliable trading system for trading in the direction of the trend?

This trading setup structure will give a high reward with low risk, so as you can allocate more capital during such setup to gain more.

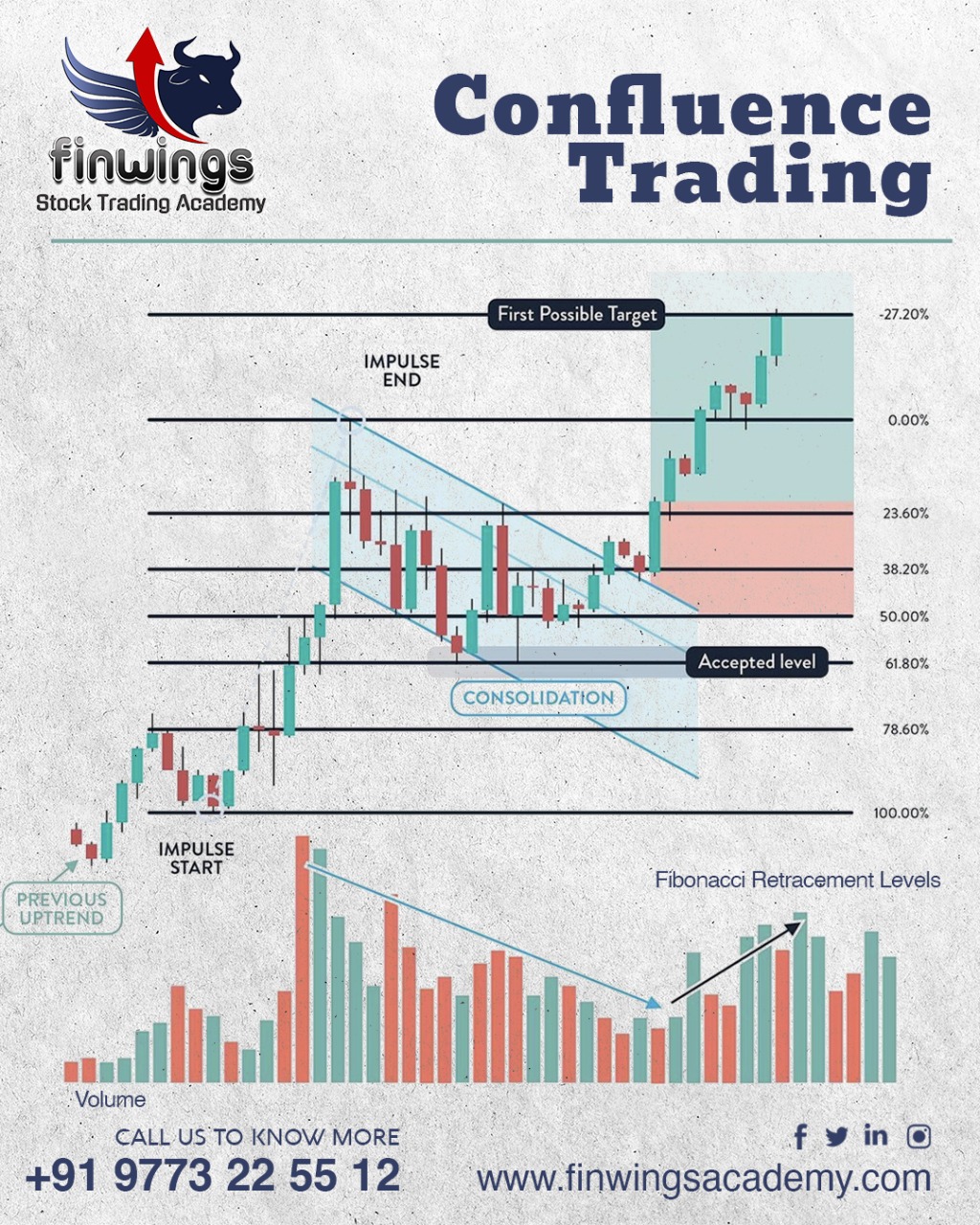

The setup formation

- Look for a trending structure, here the previous trend is a dominant one with an impulse upside formation with heavy volume.

- After the impulse move when we see a retracement with low volume participation, this hints that the buyers have not exhausted and sellers are still not dominant.

- Further confirmation comes when the retracement is till 50% – 61.8% (Fibonacci retracement tool) of the prior impulse move and then again starts moving in the direction of the dominant trend (up).

- The pullback from the retracement should witness an increase in volume.

- Finally, when the price breaks the prior swing high close with a good bullish candle with volume breakout, go for long.

- Set a stop-loss to the 50% retracement level or the swing low from where the pullback has resumed.

*While taking the profits you also need to confirm this setup with technical indicators to ensure the momentum is present and lasts long enough to reach the desired levels., eg- RSI, Stochastics, ADX.

In technical analysis, strong momentum is when the price retraces less as compared to the impulse move in the direction of the dominant trend.

The technical indicators should not be highly overbought while going long during such setup, if so we have to wait for a retest to the prior resistance breakout to level to confirm the continuity of the impulsive move that has started.

What does confluence mean in trading?

Confluence is the combination of several ideas and strategies into a single, comprehensive plan. Confluence happens when two or more distinct concepts or methods are combined to create a thorough investment plan that is consistent with the objectives and risk tolerance of the investor.

What is an example of a confluence trade?

You can place purchase orders knowing that the price will rise if the order book displays several sizable buy orders and the momentum indicator is positive. The confluence trading approach is simply a second indication that you should place a transaction.This is the best example of a confluence trade

What is the power of confluence trading?

The act of coming together is called confluence. It is a term that traders use to indicate that they have several reasons for entering a trade. Confluence theory equips you with a powerful trading strategy.

What is price action trading with confluence?

Instead of relying simply on technical indicators, price action confluent levels let traders make subjective trading decisions based on recent and historical price movements. They offer the clearest perspective of technical analysis in the Forex market.

Is price action trading profitable?

The price determines every trader’s gains and losses. In order to profit from where the market could go next, price action traders concentrate on both historical and present trends. There have been many successful price action traders, but developing price action tactics and learning to recognise trends, patterns, and reversals takes time.